Category: News

When it comes to understanding how your business is performing and how it might perform in the future, the most important tools at your disposal are the numbers coming out of your accounting software. Historically speaking though, getting the right numbers into your accounting software so you could output accurate reports was a painful process: enter allRead More »

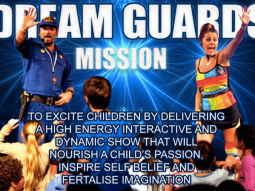

We wanted to give a big shout-out to Donna and her team this month because we love what they do and want to help them share their show with as many children on the Gold Coast as possible. Professional Comedian/Entertainer Michael Bennett and Personal Trainer/Entertainer Donna Perfect make up the dynamic Dream Guards Team. TheRead More »

In business, one of your most important resources are your staff. And in order to get the most out of your team, you need to consider how you motivate them daily. Whilst culture and atmosphere play a very significant role in that motivation, today I will focus on motivation through effective financial remuneration systems. FirstRead More »

Together with clear mission and objectives, the financial targets are the foundation of any successful business. So I just wanted to share a few thoughts around initial steps to start the process of setting targets If you don’t know where you’re going… Every business needs goals. And while many business owners are quick to developRead More »

If you have a child with a behavioural disorder, then a little-known ATO tax incentive might be available to you. The Medical Expenses tax offset allows taxpayers to claim deductions on net medical expenses – in other words, the expenses paid out-of-pocket after Medicare and health fund refunds – and this can be applied toRead More »

A popular method of avoiding taxation in the past has been to buy a property, build or renovate, live in the residence for twelve months (satisfying the appearance of ‘primary place of residence’), then selling the property – and buying another property to repeat the cycle. This takes advantage of exemptions to capital gains taxRead More »